Welcome to DNA Syndication, where we invite you to step out of your comfort zone and immerse yourself in the wonders of our planet. As a leading travel blog, we are dedicated to unraveling the mysteries, showcasing the beauty, and igniting the wanderlust within you. Join us as we take you on a captivating journey through the vibrant cultures, breathtaking landscapes, and awe-inspiring experiences that make our world so extraordinary.

At DNA Syndication, we believe that travel is the key to expanding horizons, fostering connections, and gaining a deeper understanding of the global tapestry we are all a part of. Through our curated collection of stories, practical travel guides, and expert advice, we strive to inspire and empower you to embark on your own transformative adventures.

With a focus on authenticity and immersive experiences, we delve into the heart and soul of each destination we explore. From the ancient wonders of historical sites to the untouched beauty of natural landscapes, from bustling cities to remote villages, our goal is to bring you closer to the essence of every place we visit.

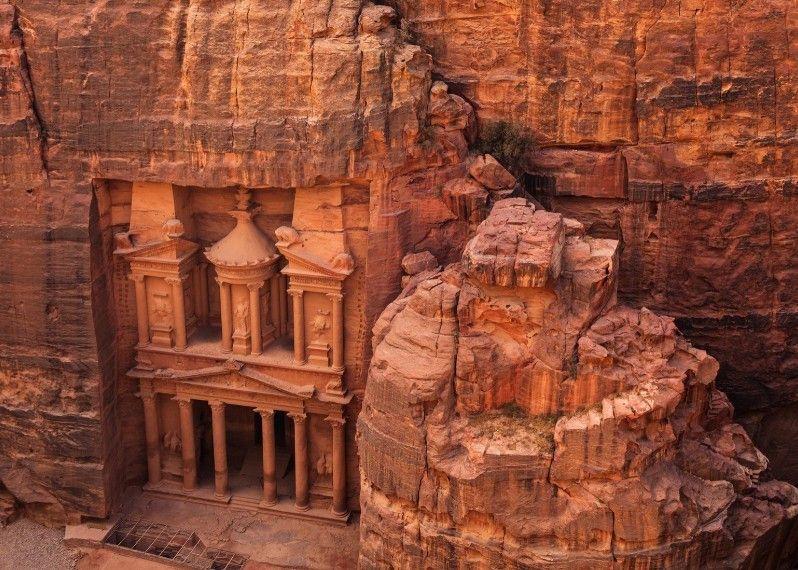

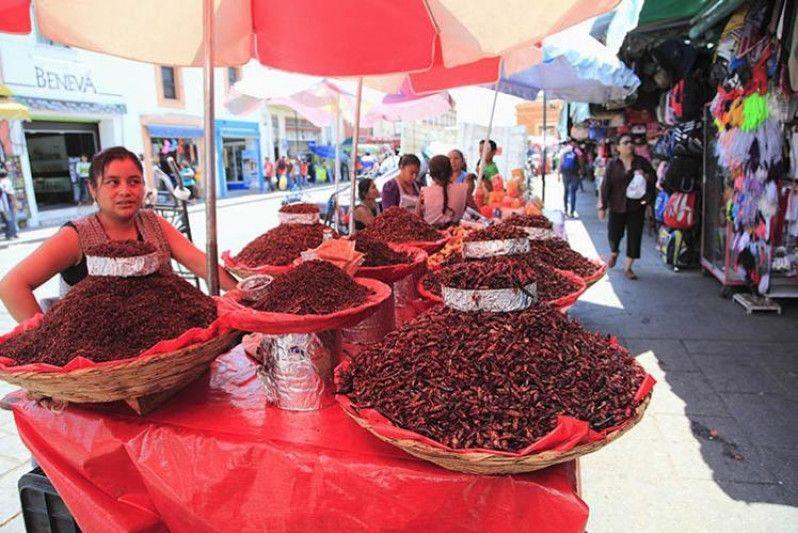

Discover the hidden gems, the iconic landmarks, and the lesser-known corners of the world. Immerse yourself in the rich traditions, tantalize your taste buds with local flavors, and connect with fellow adventurers who share your passion for exploration. From ancient wonders like the pyramids of Egypt to the modern marvels of futuristic cities, from remote islands to bustling metropolises, our blog is your gateway to the world's wonders.

So, pack your bags, open your mind, and let DNA Syndication be your trusted guide as you embark on a journey of discovery. Get ready to create memories, forge connections, and experience the beauty of our world in all its diversity.

Let us be your source of inspiration, knowledge, and guidance as you explore, discover, and connect with the world around you.

Popular destinations

Popular destinations

Other destinations

Other destinations

Top Destinations

Top Destinations

![Lake Garda: 8 best places to stay [with map]](/photo-data/photos/art/38/3866/3866765.JPEG)